Introduction

Are you looking to improve your CIBIL score in the next 30 days? Whether you're planning to apply for a loan, credit card, or just want to improve your financial health, boosting your credit score in a short time is possible. In this easy-to-follow guide, we’ll share practical and effective tips to help you raise your credit score within 30 days. Let's get started and take control of your financial future!

1. Understanding Your Credit Score (Indian Context)

What is a CIBIL Score?

The CIBIL score is a critical factor in determining your ability to get approved for loans and credit in India. It ranges from 300 to 900, with a higher score indicating better creditworthiness. A score of 750 or above is generally considered good, while anything below 600 can lead to loan rejections.

Factors That Affect Your Credit Score

In India, the key factors affecting your credit score include:

- Payment History (35%): Timely payments improve your score.

- Credit Utilization Ratio (30%): The balance between your credit card balance and your credit limit.

- Credit Age (15%): The longer your credit history, the better.

- Types of Credit (10%): A mix of credit card, personal loans, and others shows financial diversity.

- Recent Credit Inquiries (10%): Too many recent applications can lower your score.

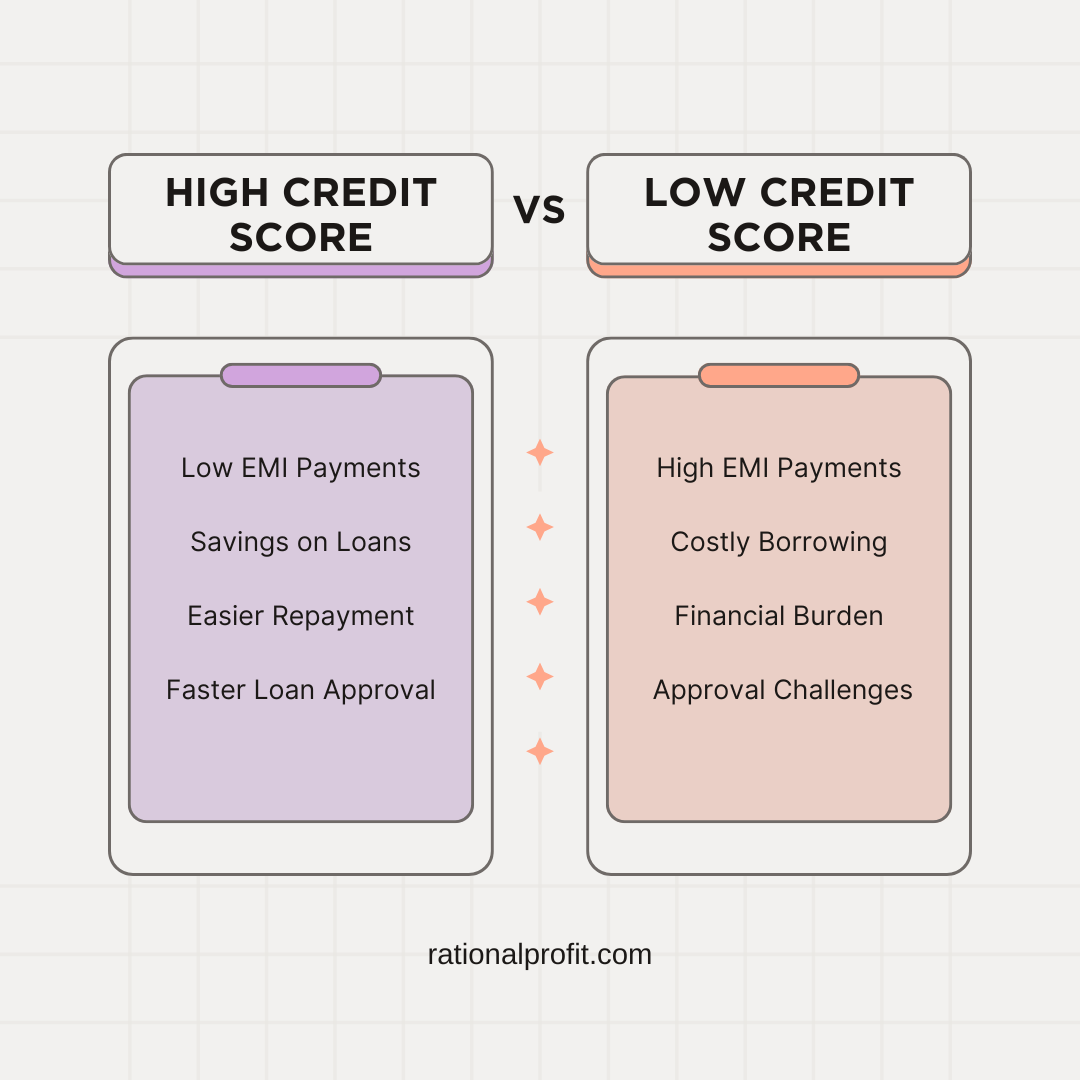

2. Why Improving Your Credit Score Matters in India

- Better Loan Approval: In India, a higher CIBIL score can increase your chances of loan approvals, whether it’s for a home loan, car loan, or personal loan. A good score means you’re less risky to lenders.

- Lower Interest Rates: With a good credit score, you'll also be able to get loans with lower interest rates, saving you money in the long run.

- Credit Card Benefits: A higher score gives you access to better credit cards with higher limits and more rewards.

3. 5 Actionable Ways to Improve Your CIBIL Score in 30 Days

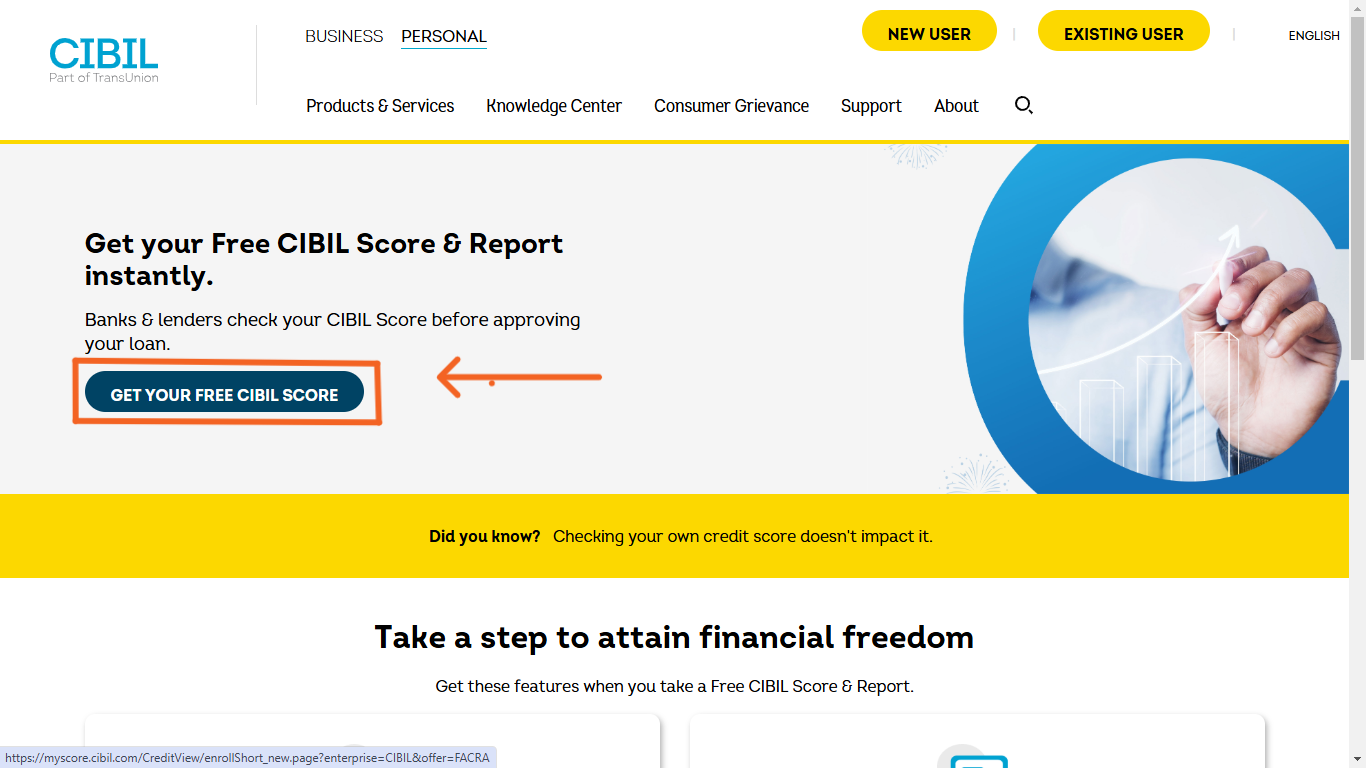

Step 1: Check Your Credit Report for Errors

- Action: Go to CIBIL or other credit bureaus in India to get your credit report. Look for errors, such as incorrect personal details or outdated loan statuses.

- Why: Mistakes in your credit report can lower your score. Dispute errors with the respective bureau to get them corrected.

Step 2: Pay Off Outstanding Balances

- Action: Focus on clearing any overdue balances on credit cards or personal loans. High balances can negatively impact your credit score.

- Why: Reducing outstanding debt lowers your credit utilization ratio, a key factor in improving your score.

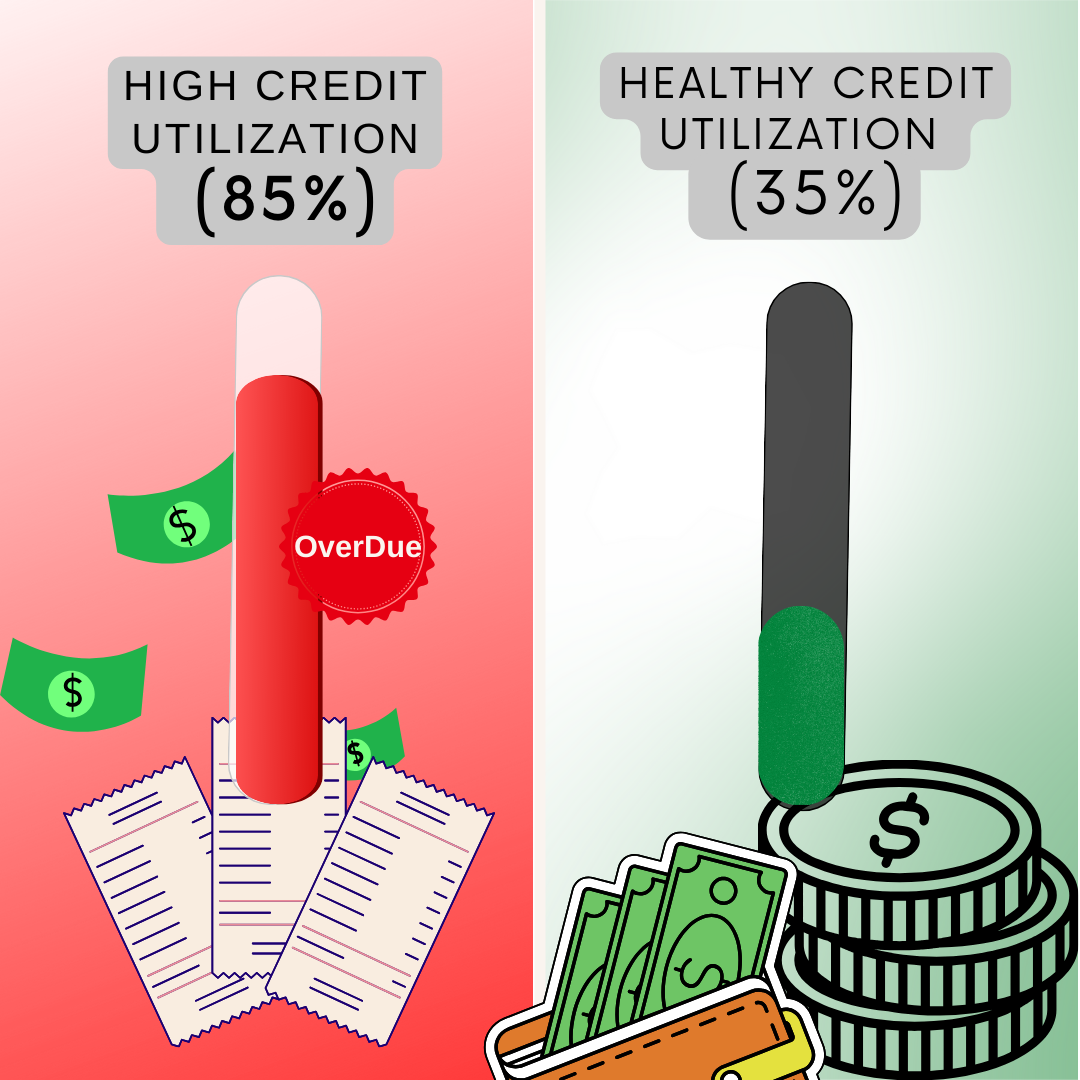

Step 3: Reduce Your Credit Utilization Rate

- Action: Aim to keep your credit utilization (how much credit you’re using compared to your total credit limit) below 30%.

- Why: High credit utilization indicates financial strain, which can hurt your score. Keeping it under control shows lenders you're financially responsible.

Step 4: Make Timely Payments

- Action: Always pay your bills on time—whether it’s your credit card bills, EMIs, or utility bills.

- Why: Payment history is the most significant factor in your credit score. Timely payments show lenders you’re reliable.

Step 5: Avoid Opening New Credit Accounts

- Action: Avoid applying for new credit cards or loans while trying to boost your score. Multiple credit inquiries can temporarily lower your score.

- Why: When you apply for new credit, the lender performs a hard inquiry that can drop your score. Stick to your current credit lines and focus on managing them better.

4. Take Control of Your Credit Today!

Download Now!

5. Conclusion

Improving your CIBIL score in 30 days is absolutely possible with the right steps and a little patience. By following these simple strategies—checking for errors, paying off balances, and maintaining a good credit utilization ratio—you’ll be well on your way to a better credit score. Start now and see the positive changes in your financial life!

Call-to-Action

Have you already tried any of these tips? Share your experience with us in the comments below!

Frequently asked questions

Here are some common questions about credit score and CIBIL Score.

Yes, it’s possible to increase your credit score within 30 days by focusing on key actions like paying off outstanding bills, reducing credit card debt, and ensuring all payments are made on time. However, significant improvements might take longer.

Improving your CIBIL score in 30 days is possible if you address critical factors such as correcting errors on your credit report, lowering credit utilization, and paying off any overdue balances. Regular monitoring can help you track your progress.

The fastest way to boost your credit score is by paying off high-interest debts, especially credit card balances. Additionally, reducing your credit utilization ratio and ensuring timely payments on all loans can provide quick improvements.

Yes, a 700 credit score is considered good. It indicates that you're a reliable borrower, and you’re likely to receive favorable loan terms and interest rates.

To increase your CIBIL score from 600 to 750, focus on timely bill payments, reducing credit card debt, keeping credit utilization low, and checking your credit report for inaccuracies. It may take a few months of disciplined financial behavior to see a significant increase.

Achieving an 800 CIBIL score requires consistent good credit habits, such as paying bills on time, maintaining low credit card balances, and avoiding new credit inquiries. It also helps to have a diverse mix of credit types and a long credit history.

A credit score of 600 is considered fair but not ideal. While it may allow you to secure some types of loans, you may face higher interest rates compared to borrowers with higher scores. It’s advisable to work on improving your score for better loan offers.

To request late payment forgiveness, contact your lender or credit card issuer and explain your situation. Be polite and ask for a goodwill adjustment. If you have a history of timely payments, they may be willing to overlook the late payment.

Yes, with a 700 credit score, you may qualify for a loan of 50,000, depending on other factors like your income, existing debt, and the lender’s requirements. However, loan terms and interest rates may vary.

No, a 750 credit score is excellent. A score in this range indicates that you are a reliable borrower and are likely to receive the best loan offers with low interest rates.

Yes, with a CIBIL score of 750, you are likely to qualify for loans with favorable interest rates and terms. Lenders generally consider scores above 750 to be excellent and a sign of financial responsibility.

While the exact credit score of Mukesh Ambani is a closely guarded secret (probably encrypted with a billion-dollar password!), it's safe to assume his score is as high as his business empire—definitely in the "excellent" range! In fact, his score might just be the inspiration for what we all aim for: 900. But, unlike most of us, he probably doesn’t need to worry about credit limits.

How to Improve Your Credit Score in 30 Days: A Step-by-Step Guide for Indians